Machine learning document processing in finance

Turning financial compliance and risk into scalable automation – a machine learning case study.

Zero

performance errors

9x

productivity

63%

cost reduction

Partner

A mid-sized European financial services provider specializing in consumer lending and investment products.

Partner’s challenges

The client sought automation of core workflows. Their main pain points included:

Excessive time spent on manual processing (up to 60% of employees’ workweek).

High error rates and compliance risks.

80% of data locked in unstructured formats (PDFs, emails, photos).

Lack of scalability to handle increasing document volumes.

Solutions proposed by Modsen

AI-driven OCR for instant machine learning document processing

ML-powered extraction and validation of key financial data

Smart classification and structured organization of large document flows

Built-in compliance checks aligned with GDPR and financial regulations

Streamlined review and approval cycles with anomaly detection

Secure cloud-based storage with role-based access for internal teams

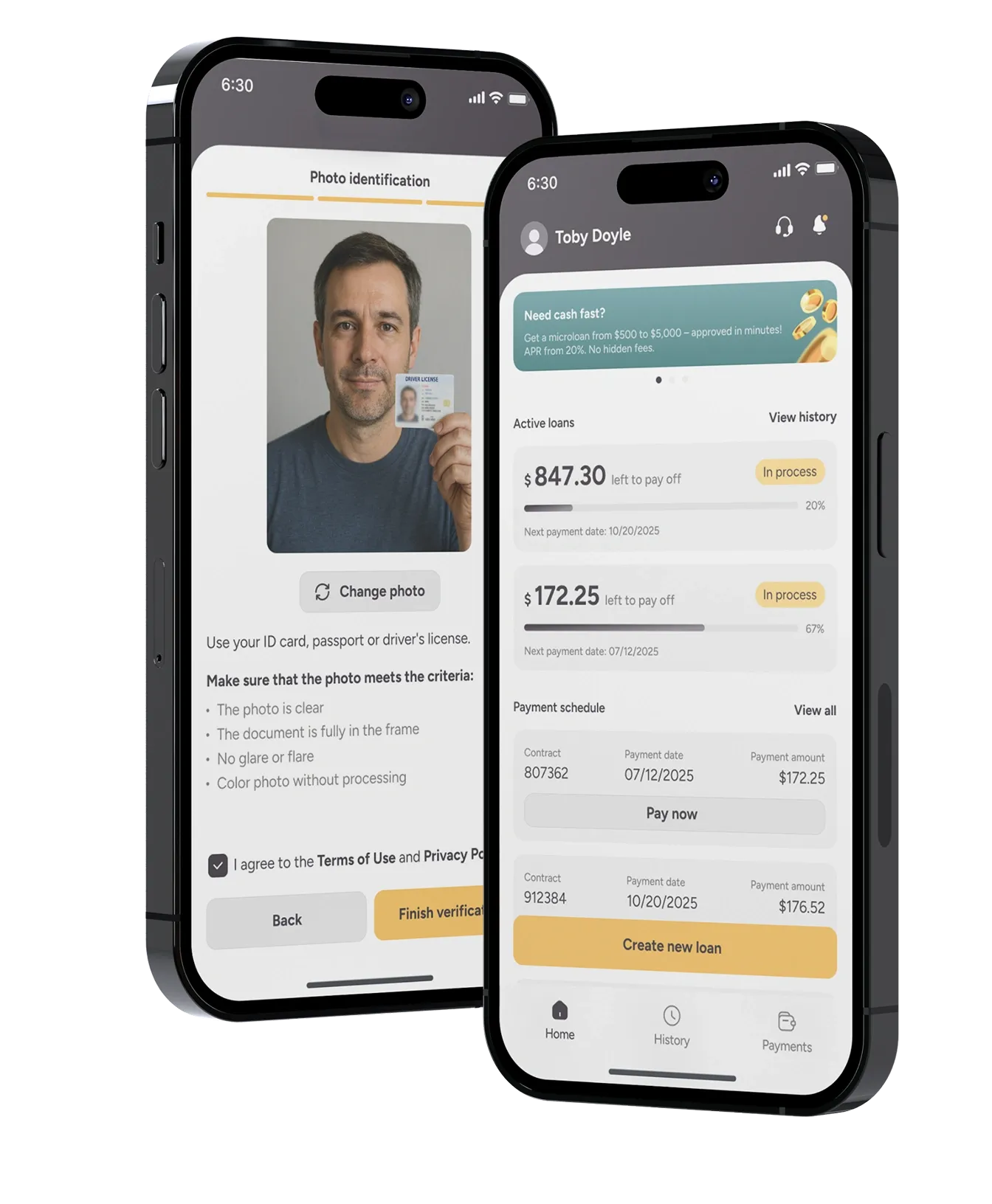

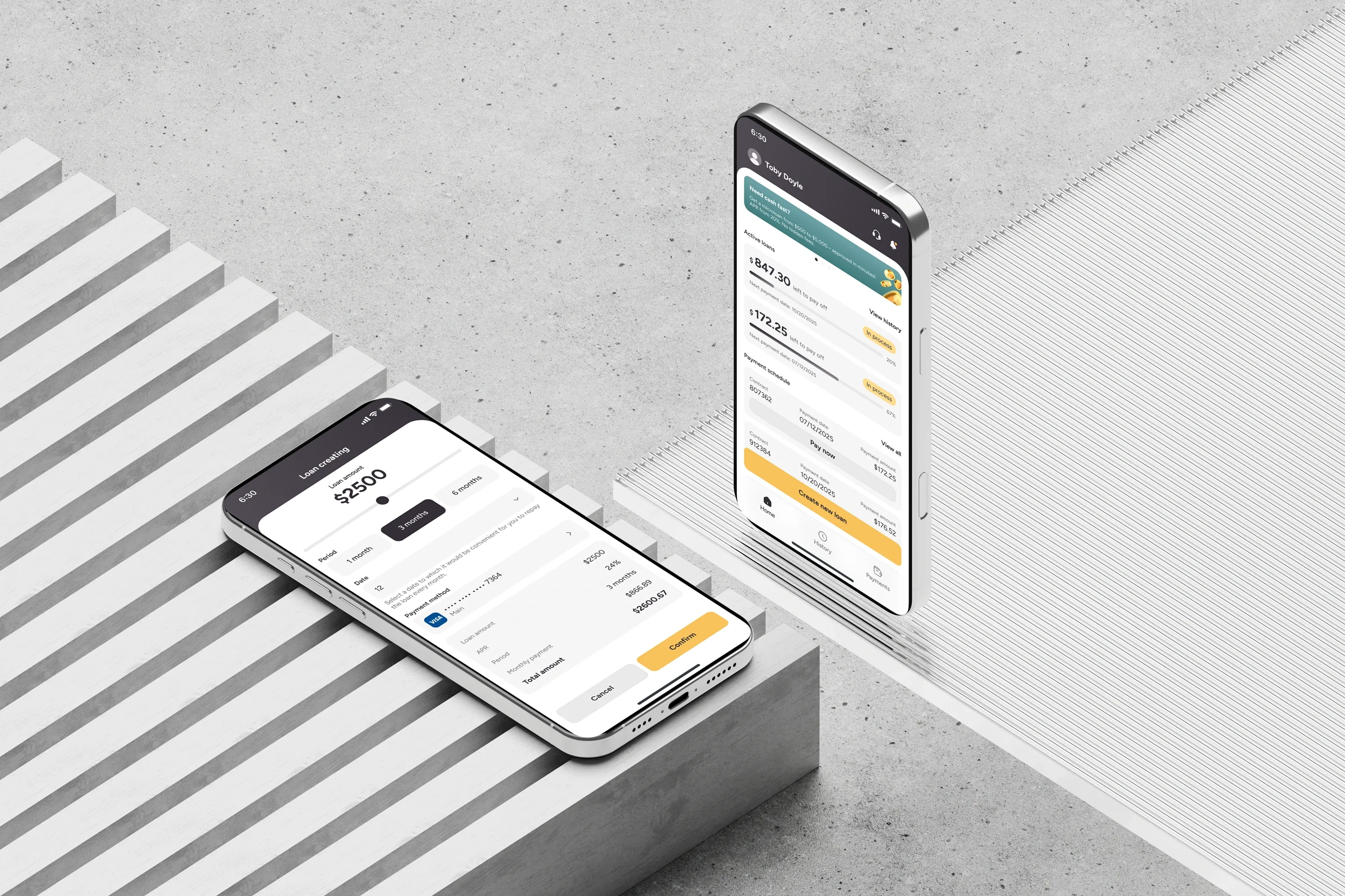

The data shown in this application interface during the case demonstration is not real customer data. All information presented is for demonstration purposes only.

Project team

1

Project manager

1

Business analyst

1

UI/UX designer

1

Team leader

1

Data scientist

4

Software developers

3

QA engineers

1

DevOps engineer

Development process

Analysis & Planning

At this stage, we worked closely with the client’s finance and compliance teams to review loan and invoice workflows, where manual KYC checks and approvals consumed most resources. A detailed roadmap was developed to minimize regulatory and budget risks and secure predictable delivery of the document processing ML solution.

UX/UI

We built early prototypes of loan approval and invoice validation dashboards. Managers could test the flows right away and suggest improvements. Modsen design standards kept everything consistent, saving redesign costs and speeding up adoption inside the company.

Development

We delivered features step by step with full progress reports. The team structured the process around parallel tracks for backend, ML, and workflow automation components, coordinating progress through shared documentation and sprint reviews. Close cooperation with key client stakeholders enabled the team to efficiently capture and implement evolving requirements within the intelligent document processing solution.

Testing

QA cycles and an external security audit proved accuracy and GDPR compliance. By catching issues before launch, the client avoided penalties and costly fixes, getting a secure and stable product from day one.

Client acceptance

The system was tested together with the client on real financial documents. Transparent demos and joint checks led to a remark-free approval and confirmed the solution’s stability and compliance readiness.

Maintenance

After launch, Modsen continued supporting the system with monitoring, security updates, and performance optimization. The team also handled adjustments to new compliance rules and business changes, keeping the platform reliable and up to date without interruptions.

Have a similar project in mind?

Book a free call with Modsen – we’ll answer your questions and discuss the best approach for your business.

Business value

Machine learning document processing

Error-free data extraction

Compliance risks and manual corrections educed by over 95%

Automated data extraction and validation

Productivity improved about 9x

Manual workload reduced by 40%

Smart classification and approval workflows

Document processing time reduced with ML from hours to ~30 seconds

Approvals and customer responses accelerated from days to minutes

Cloud-based storage and access

Operational costs cut by ~63%

Enterprise-grade encryption and strict role-based access safeguarding sensitive data

45% faster coordination due to secure, streamlined collaboration between finance, risk, and compliance teams

Let's calculate the accurate cost and resources required for your project